DISTRIBUTED CREDIT CHAIN (DCC) - Empower Credit, Enable Finance

The traditional financial industry is highly centralized. With substantial transaction fees paid out to large financial institutions, financial transactions rely heavily on the endorsement and support of these institutions. In fact, lending rates for borrowers are raised while reducing the interest income for lenders by the monopolistic financial institution. In some cases making it impossible for lenders to accurately identify the risk, the intermediaries have even distorted the credit rating of borrowers for their own benefit.

This monopoly has broken by the public chains for distributed banking based on blockchain technology. DCC can practically abolish transaction costs and commissions as the first ever distributed blockchain financial service platform. It can provide secure and convenient service that’s affordable for traditional financial institutions. All financial services firms have equal status on DCC’s public chain. There are no longer a monopolistic few who “control the whole”.

In the interest of fair market competition, the traditional major banks will have equal status with smaller institutions in the modern era. This way, competitive smaller financial firms have the opportunity to set the trend, making the overall market more active and free.

HOW WILL DCC CHANGE THE BLOCKCHAIN INDUSTRY?

The value of the DCC comes from the financial activities and transactions of all its members. The DCC digital currency will have a more concrete foundation due to increasing numbers of financial transactions which are completed via DCC. With the flow of large sums of financial capital, at present socio-economic operations go hand in hand. This brings DCC a broad range of potential commercial applications and invaluable potential.

This is the beginning of the commercialization of blockchain technology. DCC can become a high-quality digital asset which is worth holding on to in the long term with their huge market demand and by eliminating the key weakness of traditional digital currencies.

VISION AND MISSION

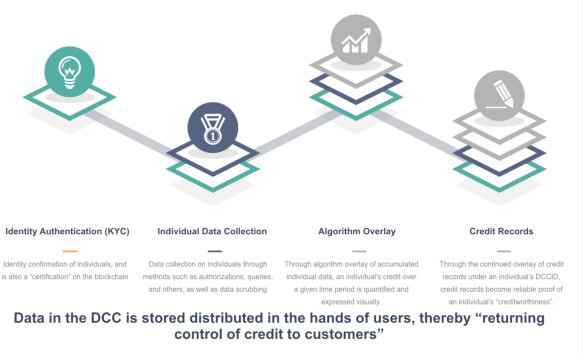

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

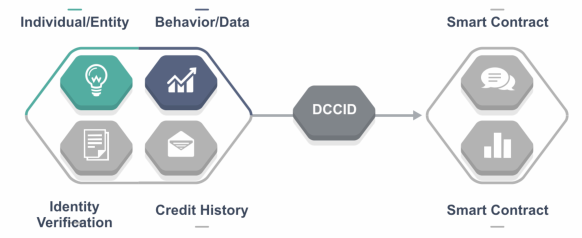

USER ACCOUNT IDENTIFICATION SYSTEM

To create an address each individual or institution has one DCCID generated through Public-Private Key Pair in DCC. This is just like a member ID in a traditional internet system which identifies and associates various real-world attributes and information on the credit chain. DCCID is a decentralized account system, and its generation does not depend on any individual DCC node. Any person, organization, or company can generate this DCCID offline. To fully guarantee the non-repudiation of an individual chain, DCC uses digital signature technology at every step of data exchange.

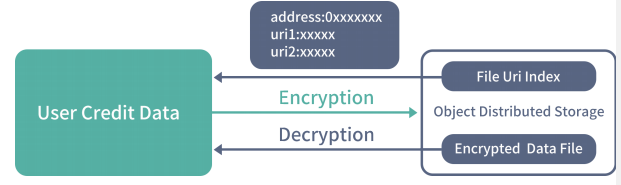

An open source personal credit data management framework which is called Distributed Credit Data Management Framework will be provided by DCC and it is supported by a specific cloud storage provider and developers. This is able to quickly rebuild users’ personal credit reporting data using DCDMF based on their APP development needs. By exporting the wallet addresses, users having a DCCID can exchange data in several APPs which use DCDMF.

Distributed credit data management framework or DCDMF is provided by DCC. DCDMF use to rebuild users data report. Users can take data any time they want using their user ID and password.

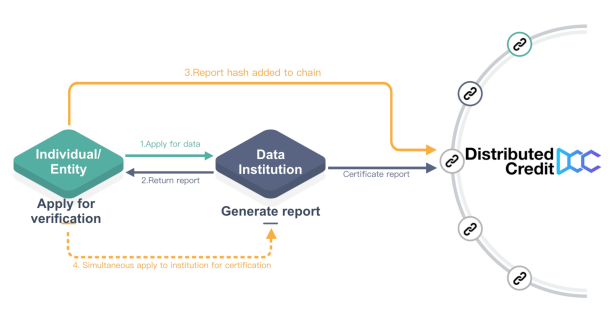

Distributed credit maintenance

Users have the authority of data via Distributed Identity Verification (DIV) and can determine the content.

In this DIV process, there is no third party involvement so the data directly passes to the user from data institution.

Distributed Credit chain make sure data generated in the blockchain is accurate.

- Personal data passed to the data institution

- Data process by the institute will receive data report

- Data report will save by individuals locally or in collude storage

- Apply report for verification

- Finally the confirmation

Data leakage is minimum during the process. Because data only passé only between individuals and data institutes.

On the other hand, data reports can use again by data institution. DIV pave the way to use data services by big data companies and AI-based companies.

APPLICATION OF DISTRIBUTED CREDIT CHAIN NETWORK

- Loan registration

- Loan consumptions

- Blockchain credit cards

- Token loan service

- Mortgage claim service

- Assets distribution

- And many more

ADVANTAGES OF THE DCC ECOSYSTEM

- Zero data monopoly

- Temper proof identity system

- Efficient

- Low cost

- Cross-entity

- Permanent data storage

- Shared right records

- Excellent assets liquidity

ADVANTAGES OF DCC

- It breaks the monopoly

DCC aims to break the monopoly of traditional financial institutions and to return earnings from financial services to all providers and users involved in with the use of global distributed banking ecosystem. Digital Banking will finally be a method to achieve an inclusive system of finance.

- Decentralized Thinking

Digital Banking will be able to change the cooperation model in traditional financial services through decentralized thinking. This builds a new peer-to-peer and all-communications model of cooperation across all regions, sectors, subjects, and accounts.

- Transform Business Structure

Digital Banking will totally transform traditional banking's debt, asset, and intermediary business structure. The tree-like management structure of the traditional bank will thus evolve into the flat structure of a decentralized bank, establishing distributed standards for various businesses and improving overall business efficiency.

- Government Regulation

As it pertains to rule, the fact that all records registered in the blockchain cannot be tampered with will enable regulators to penetrate the underlying assets in real time. Based on blockchain data analysis, large data analysis organizations will also be able to support the regulatory bodies recognize and respond to industry risks more quickly.

TOKEN DETAILS

- Ticker: DCC

- Token type: ERC20

- ICO Token Price: 1 DCC = 0.0388 USD (0.00007299 ETH)

- Fundraising Goal: 49,000,000 USD

- Sold on pre-sale: 26,400,000 USD (BONUS ~80-100% IN USD)

- Total Tokens: 10,000,000,000

- Available for Token Sale: 22%

- Accepts: ETH

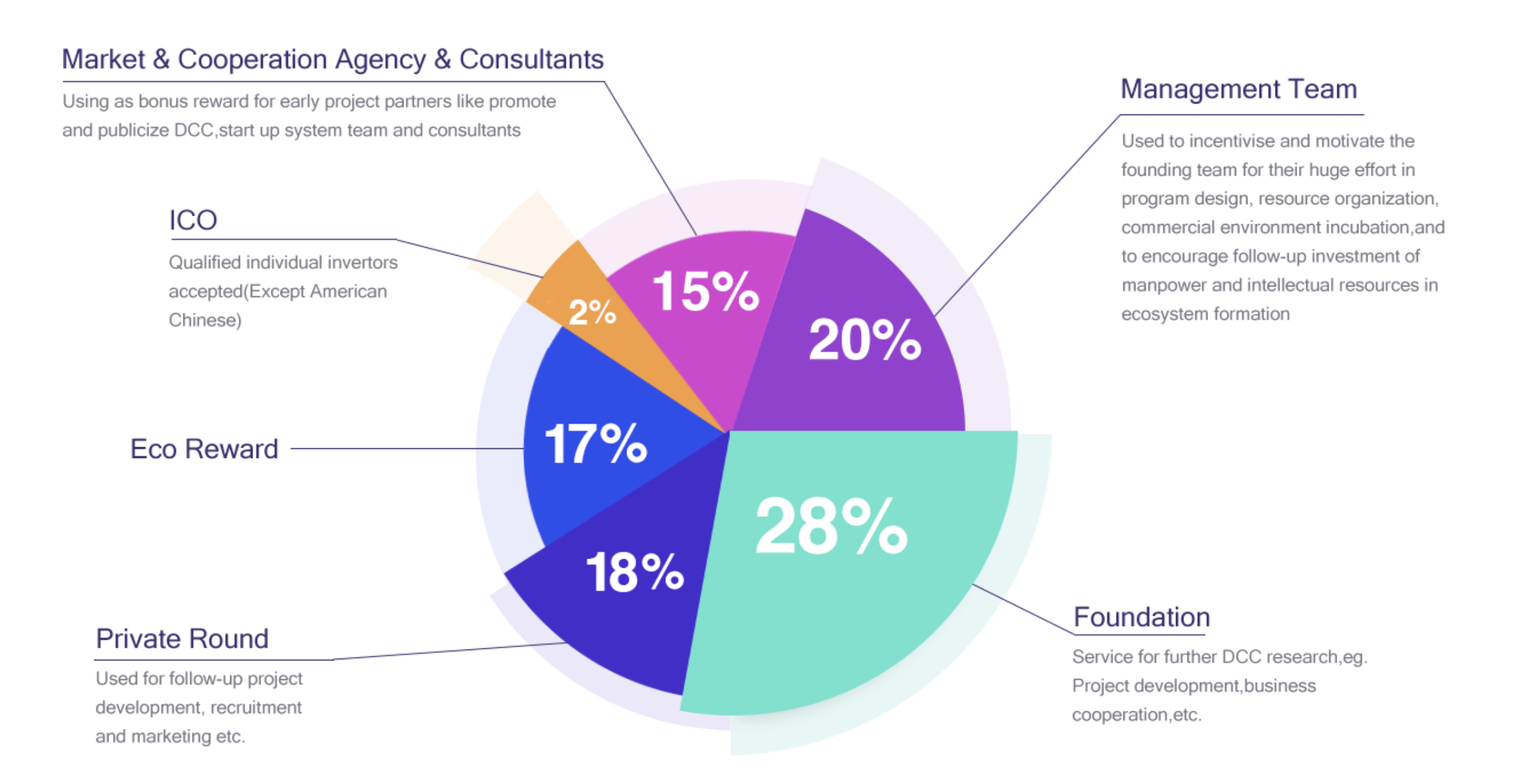

Token Allocation

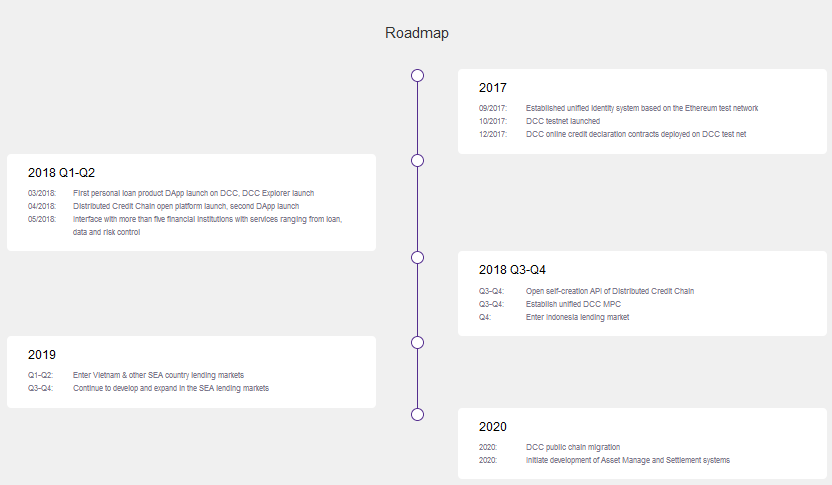

ROAD MAP

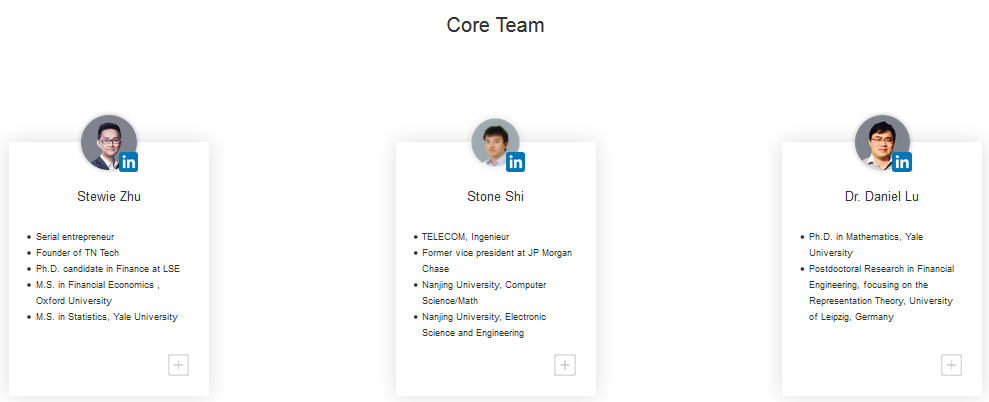

TEAM

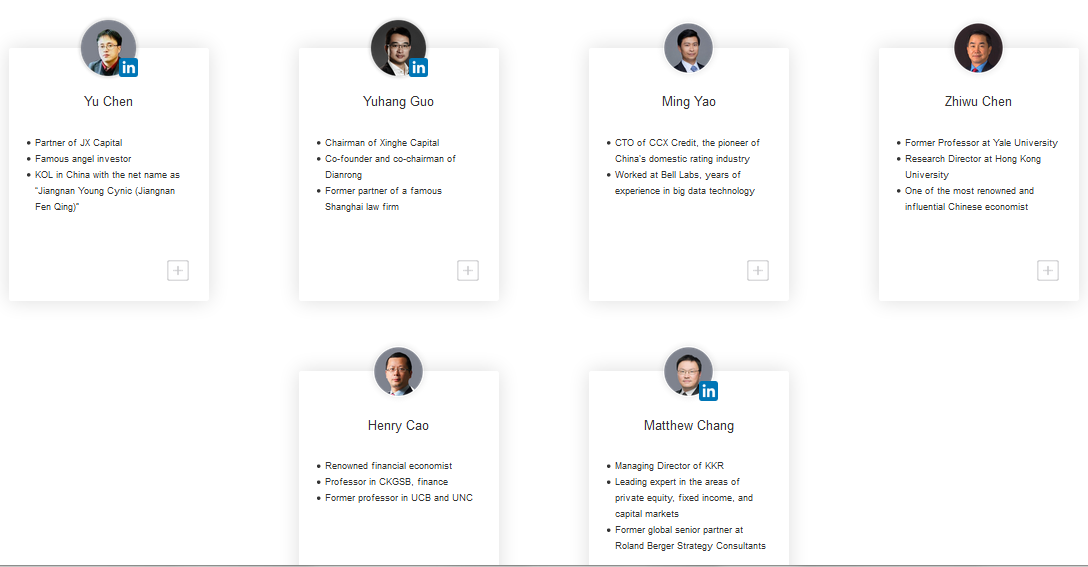

ADVISORS

For more information, please visit:

DCC Website: http://dcc.finance/

Telegram Group1: https://t.me/DccOfficial

Telegram Group2: https://t.me/dcc_official2

Twitter: https://twitter.com/DccOfficial2018

Bitcointalk: https://bitcointalk.org/index.php?topic=3209215

Author: JigaMola

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1847143

Comments

Post a Comment