USDQ - A New Era of Decentralized Future

USDQ is a collateral backed asset soft-pegged to the US dollar. Nevertheless, USDQ does not have a centralized party that maintains the fluctuability near zero. This one works in combination with the Q DAO token, a more stable coin than others in the market due to the way their value is calculated. Q DAO token does not have any fluctuation restriction, that’s why it’s role is very important in the ecosystem. The users can easily generate USDQ by providing a BTC backed amount depending on the amount of USDQ they want to issue. Those funds that were converted can easily be stored in stable value with USDQ. When they consider it necessary, USDQ holders can burn the USDQ to obtain the BTC backed amount they gave at the beginning of the process.

Q DAO is a blockchain platform, integrated with Ethereum smart contracts. It provides a number of enablers for sustainability of the generated stablecoins, such as CDPs (collateralized debt positions), automated price adjustment processes with feedback mechanisms, as well as a system of incentives for external actors.

With Q DAO Platform, users can generate various stablecoins, currently USDQ and KRWQ are available. USDQ uses Bitcoin as its collateral, i.e. in order to create USDQ users need to lock up their Bitcoins in a smart contract. The stablecoin's price is pegged to United States Dollar. Stablecoins are seen as an important enabler, paving the path toward mass adoption of DLT-powered digital currencies. In contrast to other stablecoins on the market, USDQ is fully decentralized with all of its components residing on top of the blockchain. The KRWQ (and other stablecoins, planned to be launched in the future) act in the similar way, but are pegged to their specific fiats (KRW for KRWQ). In order to simplify the description, we are referring below only to USDQ, but the reader should understand that the same always applies to all other stablecoins, such as currently available (KRWQ) and planned (CNYQ, JPYQ and others).

USDQ is a platform that makes assets stable and truly decentralized. The 1st element of the ecosystem is the exchanges. USDQ bargains on the secondary market at the price of 1 dollar for 1 USDQ, respectively traders interact with this coin, as well as with any other. To buy USDQ at the exchange is the first way by means of which it is possible to get stablecoin.

The 2nd way, which includes several important elements of an ecosystem, is receiving the credit in the stablecoin USDQ through crypto assets collateral. A pledge rate to the released stablecoin is D %, where D is the last rate established by Q Box which is a self-learning neural network, and approved by holders of the governance token. Thus, it reaches over provided credit and leads to ensuring the stability of USDQ token.

Respectively, when new crypto assets enter the ecosystem, the created smart contract prints new USDQ and sends them to the borrower. When the borrower wants to take away the collateral and return the credit, it undergoes the return procedure on the website, at the same time paying a certain interest rate for use of stablecoin credit. After the return of USDQ together with payment of commission for use of proceeds of credit, crypto assets are de-frozen and return to the address of the borrower's wallet, and USDQ tokens are burned.

The credit in USDQ tokens is issued for a limited term. If the credit lasts, then it is necessary to bring the commission in the governance tokens Q DAO. If the credit is not returned in time, then pledge in cryptocurrency goes to untouchable stabilization fund. In case of elimination process crypto assets of stabilization fund are sold first.

Collateralized Debt Position(CDP)

CDPs are simultaneously used to mint USDQ and accrue the debt. The user can withdraw the Collateral Assets at any time upon repayment of the USDQ amount, equal to the loan originally received. CDPs implement the "excessive collateralization" principle, assuring that the debt value never exceeds the value of the Collateral Assets. The technique enables CDPs to dampen a negative impact from sudden price movements for the Collateral Assets.

With this project, there are Five(5) stages associated with the process for CDP Operations. These stages is discussed below.

- Stage 1: CDP Creation

The user registers at Q DAO Platform. The user needs to specify only the email, so that the ecosystem can furnish notifications on important events. In this way, we assure a high level of anonymity. The user receives the wallet and 3 private keys (private key to user's BTC wallet, private key to our network and private key to Ether network (with the last key provided optionally)), used to access various functions within the ecosystem.

- Stage 2: CDP Activation

The user transfers a required amount in BTC to their BTC wallet within the Q DAO Platform. Then, the user sets the desired parameters for the loan to be obtained.

- Stage 3: USDQ Generation

The ecosystem checks the availability of the required amount of the collateralized assets (for instance, Bitcoins, which the user has previously collateralized within the system). Upon a successful completion of the verification, the ecosystem mints the respective amount of USDQ and furnishes the same to the user's wallet. Now the user can utilize the received stablecoin as he wishes.

- Stage 4: Equilibrating Collateral

Subsequently, the user can adjust the collateral depending on the changes to the collateral price. Should the collateral's price go down, the user must add up the collateral or repay a portion of the USDQ-denominated loan. If the user fails to take any action, the ecosystem will perform the forced liquidation process. Should the collateral's price go up, the user can increase the USDQ-denominated loan amount, withdraw a portion of the collateral or avoid taking any action at all.

- Stage 5: Withdrawal

The user furnishes a request to the ecosystem for the funds withdrawal. The user should repay to the ecosystem the earlier received USDQ-denominated loan and the Stability Fee, which accrues throughout the loan term and payable in Q DAO token. The user utilizes the private key in order to sign the transaction, enabling the user to get the collateral assets back to his wallet.

How to get USDQ

Via the OTC desk. It takes more time, but it’s much more profitable, as they are sold with a discount there. All tokens bought via the desk, get frozen for a certain period of time but with its own bonuses.

Go to Hotbit or BTC-Alpha since they have listed Q DAO recently. By making a purchase on the exchange, you don’t have to deal with lock-ups, and you can start trading tokens immediately, but you have to pay the full price.

And, you can participate in the Q DAO IEO conducted on BTCNEXT. The first round is already completed and the second round started on the 1st July of 2019.

Get USDQ through IEO at BTCNEXT exchange. Also USDQ is already trading at Btcnext,Btc-Alpha,HotBit

- https://my.btcnext.io/advanced

- https://btc-alpha.com/en/exchange/BTC_USDQ/

- https://www.hotbit.io/exchange?symbol=USDQ_USDT

How The Token sale works

- Tokens to sell

Distribution of 51% of tokens (509999.49 QDAO tokens).

- For how long

Distribution will be made in 10 Rounds. Round stast at 1st day every month during 10 month will be distributed 50000 Tokens during each round.

- Where to buy

QDAO distributes 30% tokens by IEO(all tokens are unlocked) and 70% tokens by OTC desk (tokens will be locked for a certain period of time).

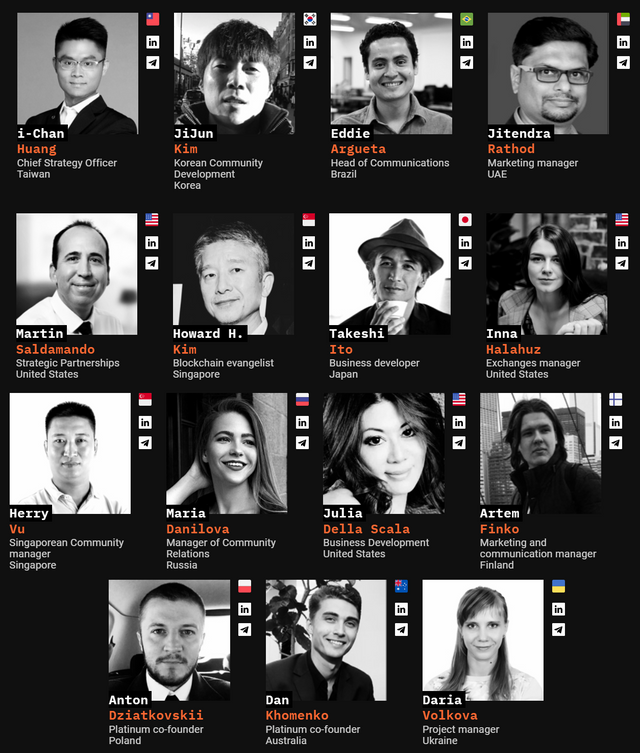

Team

For more information, please visit:

WEBSITE: https://usdq.platinum.fund/

WHITEPAPER: https://usdq.platinum.fund/whitepaper

ONE PAGER: https://usdq.platinum.fund/onepager

FACEBOOK: https://www.facebook.com/FundPlatinum

TWITTER: https://twitter.com/FundPlatinum

TELEGRAM: https://t.me/Platinumq

MEDIUM: https://medium.com/platinum-fund

REDDIT: https://www.reddit.com/user/Platinum_QDAO

LINKEDIN: https://www.linkedin.com/company/platinum-co/

GITHUB: https://github.com/Platinumengineering/USDQ

WHITEPAPER: https://usdq.platinum.fund/whitepaper

ONE PAGER: https://usdq.platinum.fund/onepager

FACEBOOK: https://www.facebook.com/FundPlatinum

TWITTER: https://twitter.com/FundPlatinum

TELEGRAM: https://t.me/Platinumq

MEDIUM: https://medium.com/platinum-fund

REDDIT: https://www.reddit.com/user/Platinum_QDAO

LINKEDIN: https://www.linkedin.com/company/platinum-co/

GITHUB: https://github.com/Platinumengineering/USDQ

Author: JigaMola

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1847143

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1847143

Comments

Post a Comment